It used to be that the mere thought of burning coins would set off an erratic thought process of you know what I could do with that many coins? However, it’s now commonplace to destroy coins, at the protocol level, for one reason or another. In the interest of your well-being (and my sanity), I researched the why, what, and when of PIVX’s coin burn and what it means to you and me.

The great burn of 2016

Since its inception in 2016, PIVX has been burning coins for the greater good. There is, of course, a good reason for a project to burn its product. At its core, coin burning is a means to control, if not an outright means to deter, the inflation of the subject coin.

For a better understanding, let’s use diamonds as an example. Better yet, let’s go back some ten years before the rise of lab diamonds became a norm. While you and I know diamonds are expensive, they’re not necessarily rare. Their price is set by both good marketing and a limited usable supply. If De Beers released all the diamonds they supposedly have access to, the price would plummet, and I could buy all of my kids some shiny rocks to use as confetti.

Alas, that’s not the case. De Beers (and others) severely limit the availability of cut diamonds, thus keeping the price at the upper level and not for everyone.

This is similarly the case with many coins- they’re burned to manage inflation. That is what PIVX does too. Today it’s all done without any interaction. However, there was a single time that a burn was done outside of the norm.

When PIVX was started, there were no PIVians (that’s you and I) around to run nodes yet. So the developers had to produce 60,001 PIV to start the first six nodes of the system. However, once the system was running, there was a coin burn, of, you guessed it, 60,001 PIV.

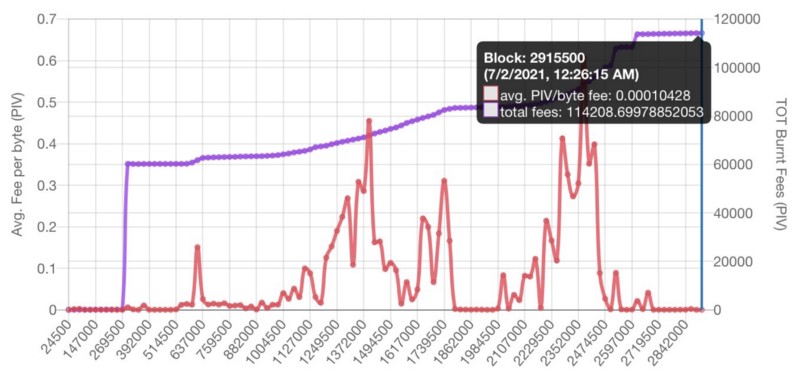

Since then, however, burning has taken place nearly every day since February 2016. See, the developers, when coding the core of PIVX, had the idea of automating the inflationary check/balance of the ecosystem. Therefore, they planned to automate the burning of all transaction fees.

Every time you and I make a transaction using PIVX, either moving or spending coins, we’re assisting with capping the available supply of PIVX. Go us!

Flame On

The given name of “coin burn,” is a misnomer. It almost conjures up an image of someone sitting at a computer printing out virtual coins only to burn the paper (or, is that just me?).

In fact, all of those coins- all 114,208 PIV- are still, technically, alive. Unfortunately, however, they are forever inaccessible by anyone.

The process of a coin burn is when funds, or in the case of PIVX transaction fees, a fraction of funds, are sent to an address that nobody has the keys to. The only access anyone has is the graph (the bottom one) that keeps tabs on the accumulation of burnt fees. While that seems like a lot, I just remember that it’s all locked away for my benefit- making my held PIVX that much more scarce (and potentially more valuable).

So remember, whenever you’re moving your PIV from one wallet to another, you’re helping the rest of the supply dwindle by a smidge. And for that, I thank you.