Special thanks to PIVian turtleflax for preparing this official response.

On June 1st, 2018, Joël Valenzuela published this article for DashForceNews about crypto coin supplies, their distribution, and their implications. Seeking to promote Dash and draw contrast with competitors, the article included various statistics about coin distributions in other popular crypto coins. One such coin is PIVX, a 2016 code fork of Dash that has since made significant improvements such as converting to Proof of Stake, creating the only PoS implementation of the Zerocoin privacy protocol, implementing the most advanced Zerocoin implementation on the market, and creating the only private staking system in crypto.

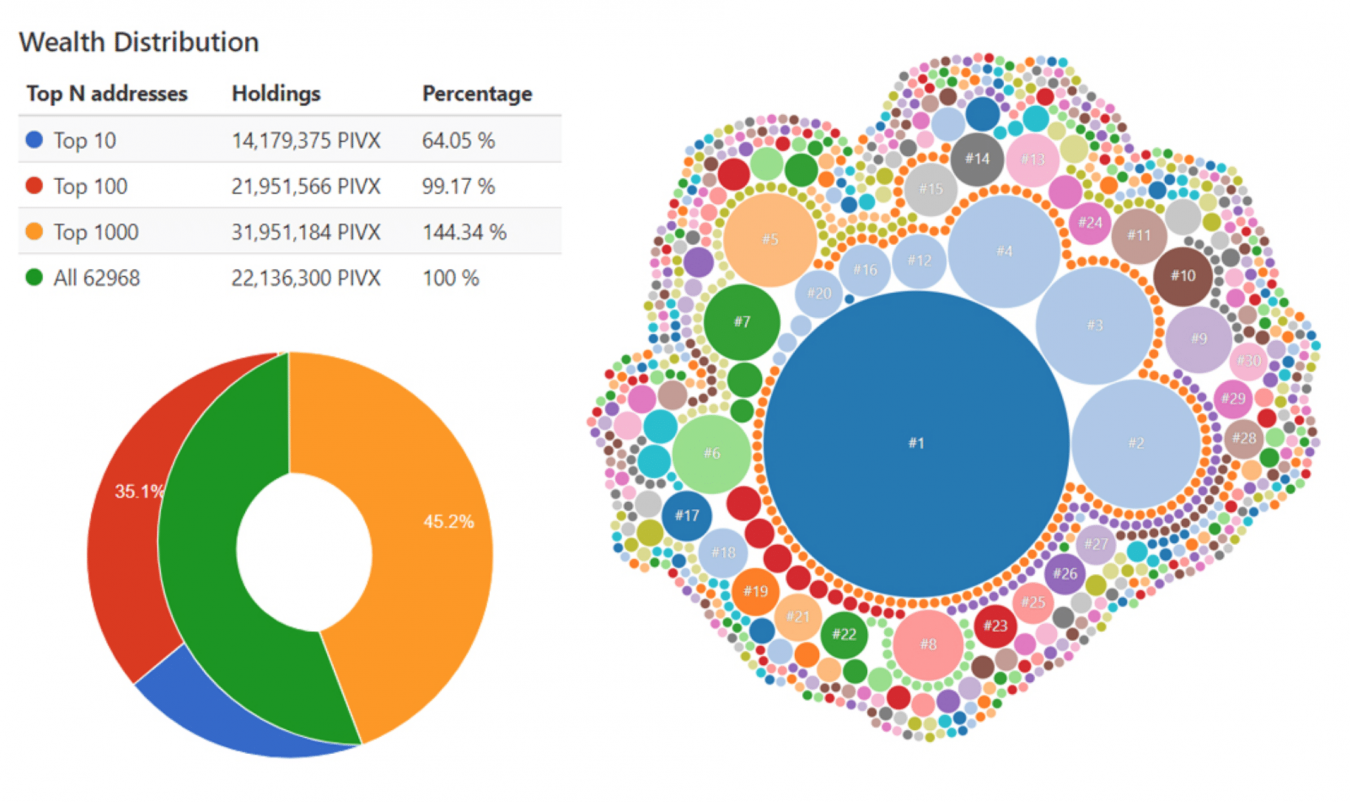

The article includes the following text and image:

“A degree of centralization of distribution is to be expected in newer coins, as is the case with PIVX. However, in this particular case the supply is extremely concentrated, with the top 10 addresses containing nearly two thirds of the entire supply, half of that remaining in a single address.”

It should be immediately apparent to any reader that the data erroneously suggests the Top 1000 addresses hold 144% of the coin supply. A glance at the rich list page on the block explorer where this data comes from quickly shows that the top “address” is the anonymous Accumulators which represent the private tokens on the network. Obviously all the private tokens on the network do not belong to 1 person or address which, given the size of our private supply, significantly warps all of this data.

It may be that Dash is unfamiliar with cryptocurrency privacy mechanisms, but most block explorers are based on bitcoin and do not interpret Zerocoin, Zerocash, or Cryptonote privacy transactions well. When you account for the Anonymous “address” the actual Top 10 and Top 100 distribution numbers are 11.9% and 25.3% respectively, not 64% and 99%. I would invite you to check out accurate data directly from our official block explorer here or node data here. These show the correct amount of the zPIV supply as an amount and percentage of total coin supply.

The article goes on to say:

“This is especially problematic because PIVX is a proof-of-stake coin, meaning that new coins can only be created by those already possessing some to begin with. Additionally, PIVX employs a governance and treasury model, with stakeholders voting on development decisions and the distribution of funds for projects, giving the extremely centralized distribution ramifications far beyond simple possession of funds.”

This is misleading in a few ways. Combined with the prior misinformation, it is implying that PIVX operates using a “rich get richer” reward system and plutocratic governance. The reality is that PIVX’s staking reward system provides proportional rewards to all stakers and has a minimum collateral of only 1 coin. Conversely, earning passive ROI on Dash is limited to the wealthy, requiring 1,000 coins for a Masternode or $305,000 at the time of writing. Please see this article for more information about PIVX’s coin emission, rewards, and inflation rate.

For further accuracy, this article should mention that on almost every coin, many of the richest addresses belong to exchanges. Additionally, Dash should also mention that masternode coins provide an incentive for large holders to split up their funds among addresses which makes the coin supply look more favorable. The article also mentions Smartcash’s community fund address as if it represents a single owner of half the supply, however these are governance controlled funds.