(A repost/updated article from 2018)

By Robert DeVoe

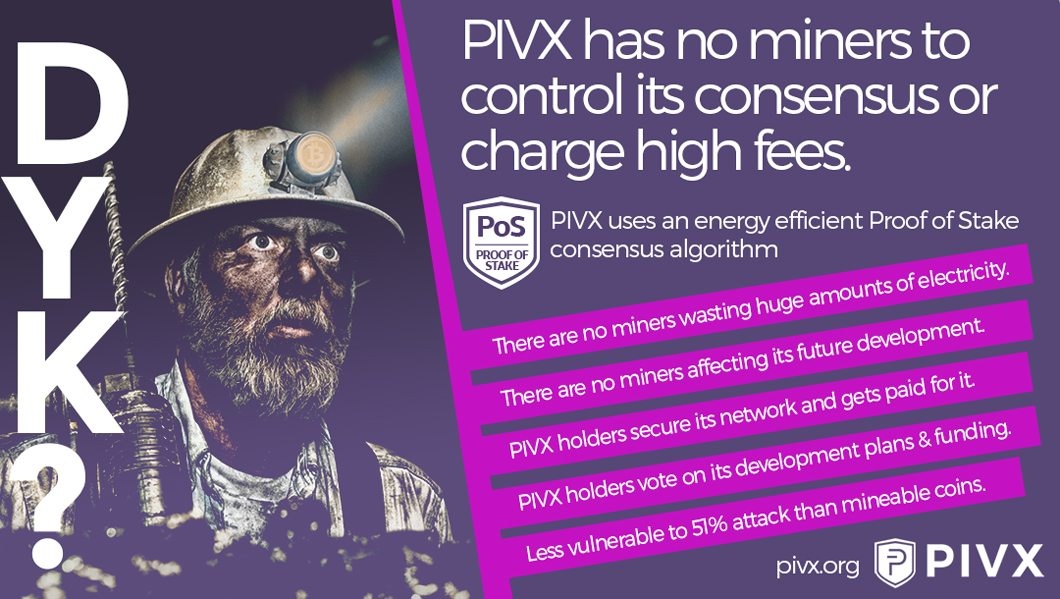

Industrial-scale mining operations that burn through electricity have put the power to control the networks in the hands of just a few. Individual miners have to rely on mining pools to compete, but mining pools themselves also act as a force for network centralization.

Centralization leads to massive vulnerabilities and increased risks of network attacks. Mining is quickly becoming more of a problem than a solution, and even long-standing pillars of the community are speaking out against it. One cryptocurrency is working hard to offer a real solution to all of these issues. That project is PIVX.

In this article we’re going to go over some of the biggest risks that cryptocurrencies like Bitcoin are facing, and how the team behind PIVX has come up with innovative solutions for all of them.

Bitcoin mining uses too much energy

You may have heard this argument before, but Bitcoin mining is consuming an increasingly large percentage of the world’s energy. Today’s estimates suggest that mining operations are now consuming as much or more electricity than the entire nation of Denmark.

This is because Bitcoin mining is accomplished by running energy-hungry mining computers 24 hours a day, seven days a week. Each individual device, such as the Bitmain S9 consumes a steady stream of upwards of 1400W of electricity.

Most mining today is done by massive, industrial-scale operations. A popular destination for such operations is Iceland. The government of Iceland has warned that they are running out of resources to feed the endless demand for more energy for mining operations. In fact, they have stated that if they allowed every investor or company that wanted to start such an operation to do so, they would be totally unable to keep up with the demand.

So what’s the solution to the energy consumption conundrum? PIVX doesn’t use mining at all. Instead, it uses an advanced version of what’s called proof-of-stake. Basically speaking, instead of running energy-intensive mining operations, anyone can buy and hold units of PIVX, and earn a reward for doing so. This is because when a user holds PIV in an online wallet, their computer will continuously stay up to date with the network and help propagate transactions and updates.

With PIVX, blocks occur every minute. In each block, a cryptocurrency reward is given to the winning staker that won the lottery-style draw for that block. This type of “mining” is preferable to Bitcoin style proof-of-work mining because it requires no more energy than just leaving ones computer on. It also doesn’t require any expensive (and quickly obsolete) custom hardware.

To put it simply, PIVX will never have an energy crisis because it will never need much energy at all. Estimates put the energy needs of the entire network to be somewhere around just one wind turbine.

The spectre of Bitmain and the man behind it

Another popular location for large-scale Bitcoin mining operations is China. This is because most mining hardware today is made in China. There are also several territories within the country that have comparatively cheap energy and infrastructure costs.

The biggest of these operations is run by the makers of most of the worlds mining hardware, Bitmain. Not only does Bitmain make the mining hardware that runs the majority of the network, they also set up cavernous mining farms with tens of thousands of machines.

In response to this, the co-owner of bitcoin.org and bitcointalk.org known as Cøbra released a paper outlining his concerns for the centralization of Bitcoin mining, and the risks that he feels Bitmain represents. Cøbra writes:

“More and more of the network hashrate is starting to become concentrated into the hands of one man [Jihan Wu] and his company [Bitmain]. The security of our network essentially depends on them acting honourably, and us being prepared to respond to it. They get more powerful each day.”

Further, Cøbra warns of potential political implications, saying: “[Bitmain is] in a position where the Chinese government can take over their equipment at any time; something they will no doubt do if Bitcoin grows enough to allow them to use their control of the hashrate to push a Chinese geopolitical agenda.”

Because of the way PIVX was designed, and the fact that it simply does not need thousands of expensive mining computers to run its network, this sort of issue can never happen. The proof-of-stake model means that anyone with consumer level hardware and a few units of PIV can participate on the network. This leads to broad decentralization, and a much stronger resistance to attacks that would rely on a single point of failure.

With PIVX, it is impossible for one person or one company to dominate the network. This is because network domination would require a massive majority ownership of almost all available PIV units (nearly 99% of the supply!) and that just isn’t feasible.

ASIC mining leads to centralization

For those cryptocurrencies that are lucky (or unlucky) enough to have ASIC miners, the centralization of proof-of-work mining seems to be an inevitability. Today, Bitcoin mining is done almost exclusively by centralized entities. These entities include large mining operations, as well as mining pools that conglomerate the resources of many small miners into a single mining entity.

While the topic of mining centralization may be controversial to some, it is a simple truth that the more centralized something becomes, the easier it is to shut down. Centralized services are also far more vulnerable to attack, such as the classic 51% attack that experts have been warning about for years.

The popular cryptocurrency Dash is facing such a threat now. According to mining pool operator P2Pool Mining, around 50% of all blocks on the Dash blockchain are being mined at just one single pool owned by Bitmain. While the pool provider is careful with its language, they suggest in no uncertain terms that having so much of a single networks mining occur in one spot is dangerous.

In the P2Pool Mining statement, they suggest that the issue began to develop shortly after the launch of a Bitmain created, Dash compatible X11 ASIC miner was released. Specifically, the Antminer D3.

Mining centralization can be such a problem that some proof-of-work based cryptocurrencies take great care in designing their networks to be ASIC resistant, or even ASIC proof. But given enough incentive, it seems likely that ASICs could be developed even for currencies that are supposedly designed to resist them.

Litecoin, for example, was designed to use the Scrypt algorithm so that Bitcoin ASICs could not mine it. However, Bitmain eventually developed a Scrypt compatible ASIC miner, the Antminer L3.

When it comes to PIVX, however, it is truly immune to the interference of ASIC mining devices. It is also essentially immune to a 51%. Such an attack on PIVX would require a single entity to control nearly 99% of the network.

Summing it all up

So what does all this mean? Cryptocurrencies like Bitcoin, Litecoin, and Dash are facing a growing problem. That being, rising energy costs and usage, the centralization of mining, and a company that has a near monopoly on nearly all ASIC mining hardware.

PIVX was created with a few goals in mind. One of the most important goals among them was to make a cryptocurrency network that was as maximally distributed, decentralized, and consequently as secure from attack as possible. In the 2.5 years of PIVX launch, the team have added some serious features, putting it on par or with other coins, and in many ways even surpasses them. At the current time their privacy features are offline due to some vulnerbilities with the zerocoin code, but the devs are working on the next level privacy protocol to be released in early 2020 if all goes as planned.

2019-2020 is going to be a major year for PIVX as dozens of new features are slated to come out. While Bitcoin and other cryptocurrencies are still trying to get their act together and solve old problems, PIVX will be blasting forward into what will certainly be some of the most advanced cryptocurrency tech on the market.